Accurately identify genuine risks

Global Relay Surveillance combines accurate risk identification and powerful noise reduction to help you focus on genuine areas of concern.

We go beyond traditional keyword analysis, using generative AI to review messages in their entirety and make alert decisions based on the context of the message. By separating true threats from the noise, analysts are empowered to prioritize meaningful investigations.

How it works

Our five-layered approach to communications monitoring turns large amounts of data into actionable insights, helping you focus on real risks.

Enhance decision making with quality data

We organize data into a standard, consistent format to ensure all your communications data is structured, easy to find, and ready for analysis.

Features

Complete data capture

Capture and normalize communications data from all approved business channels with Global Relay Connectors.

Targeted surveillance

Use categorization tags on messages to group by specific users, route alerts to people with specialist skills, and limit access controls.

Language detection

Sort messages by language to ensure they are reviewed by the right people.

Optical character recognition

Extract text from scanned documents and images and convert into machine-readable data for faster analysis.

Sentiment analysis

Identify potential risks, such as customer complaints or harassment, by detecting the emotional context in messages.

Simplify communication for efficient analysis

With transcription of voice calls, and message translation across more than 50 languages, all communications are converted into clear, consistent, and usable data.

Features

Intelligent transcriptions

Transcribe voice calls into accurate, searchable text, streamlining the process of identifying potential risks.

Message translations

Translate messages and alerts into over 50 languages, ensuring reviews are conducted in the reviewer’s native language for greater accuracy and efficiency.

Streamline your review process

Filter out irrelevant content, spam, and duplicates early to reduce clutter and speed up your review process.

Features

Rules-based filtering

Remove irrelevant content early by using pre-determined keywords and metadata so you can focus on real risk.

Approved content and senders

Create a list of content that doesn’t require review, such as marketing material, agreements, and reports, as well as a whitelist of trusted senders.

Spam and promotion detection

Identify and filter out spam and promotional messages early, preventing unnecessary clutter in your review queue.

Disclaimer and signature detection

Exclude disclaimers and signatures from analysis to reduce false positive alerts.

Custom AI models

Global Relay AI Studio allows you to train and test new AI models using your own data, so you can align the system to meet your business needs.

Duplicate flag suppression

Suppress previously flagged messages from being reviewed again each time someone replies in the conversation.

Pinpoint potential risks with AI precision

Using generative AI, we analyze messages against a comprehensive set of risks to accurately identify conduct and compliance risks.

Features

Context-based alerts

Our Large Language Model (LLM) analyzes each message in full, either on its own or combined with lexicon analysis, to deliver context-driven alerts – including attempts to avoid surveillance.

Alert explanation

Generative AI provides an explanation for each alert raised to clarify where the potential risk lies.

Lexicon analysis

Identify pre-determined risks in messages by using lexicon analysis either on its own or combined with AI-powered risk identification.

Queue routing

Streamline your workflow by routing policy alerts to the right people based on language, geography, corporate function, and more.

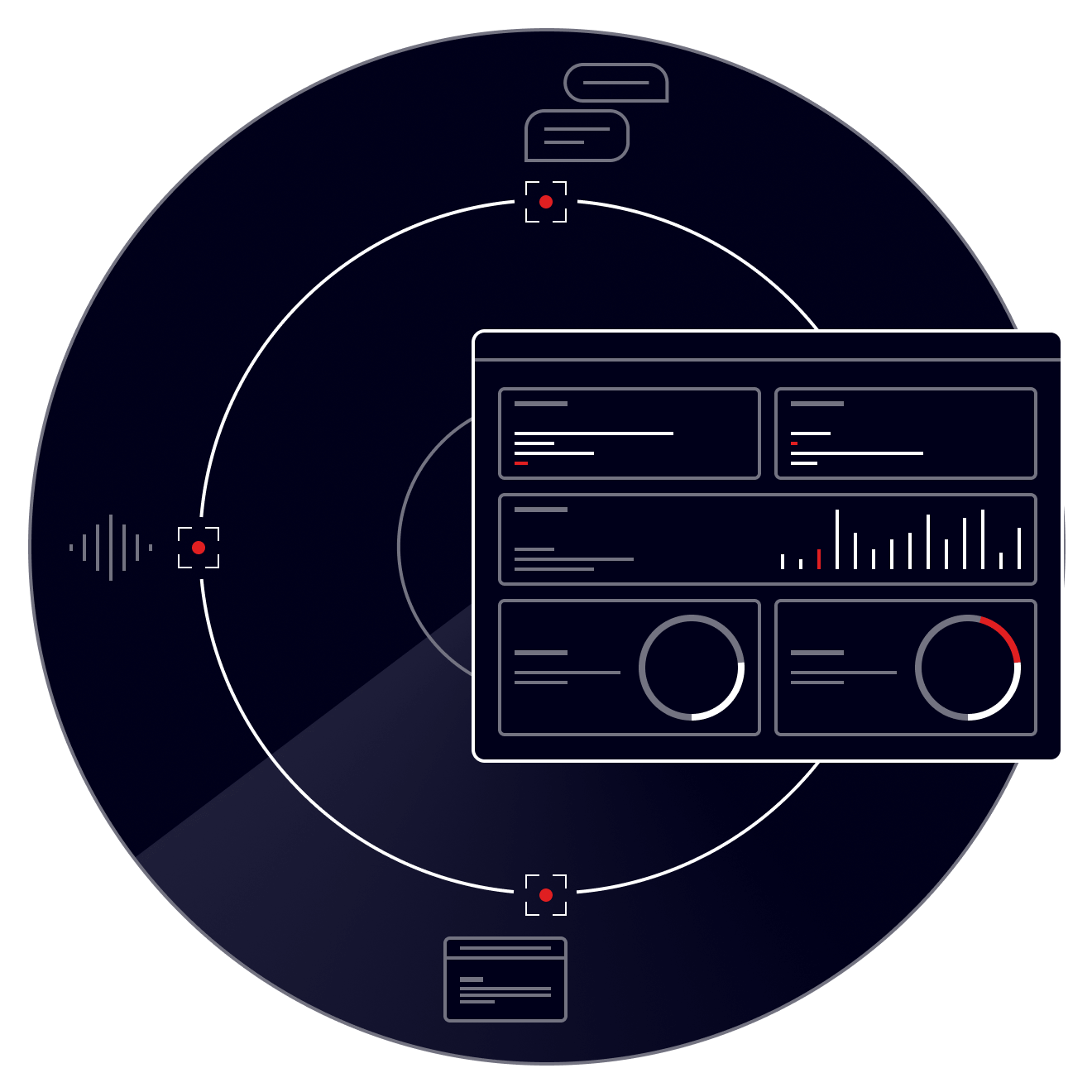

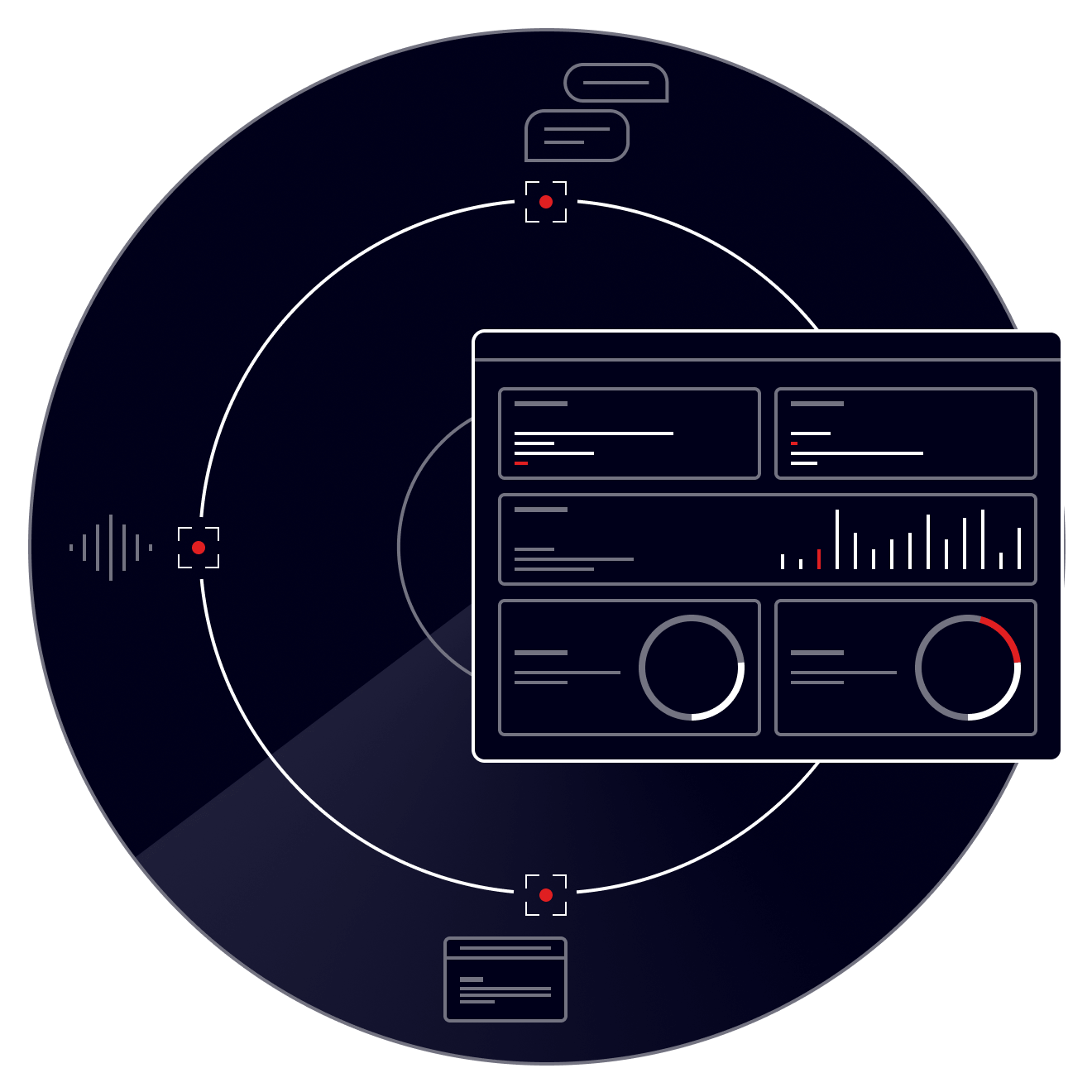

Complete compliance monitoring and reporting

Gain full visibility throughout your surveillance workflow with advanced alert management tools, intuitive dashboards, and insightful reporting.

Features

Fully traceable audit trail

Maintain a complete, time-stamped audit trail of all message modifications or deletions for transparency and compliance.

Activity overview dashboards

Keep compliance workflows on track with activity dashboards. Use filters to monitor case statuses, alert progress, frequent policy flags, and more.

Compliance reports

Access audit-ready reports that provide clear insights and evidence of your surveillance activity so you’re always prepared for inquiries from auditors, executives, or regulators.

Stay ahead of regulation with complete communications monitoring

Meet voice surveillance demands

With regulatory demands on voice surveillance increasing, you need a strategy that meets global requirements. Our voice-to-text transcription solution captures and monitors voice communications with accuracy, speed, and consistency.

Rely on responsible and secure AI

Global Relay takes a responsible approach to AI governance, ensuring data security and compliance with global regulations. Our risk management framework protects your data and aligns with regulatory standards and best practices.

Keep your data secure

We host our AI models within our private data centers, safeguarding your data's security and giving us the freedom to adopt the latest, best-in-class technology.

React quickly to emerging risks

Our LLM has a broad knowledge base adapting to emerging risks with simple prompt adjustments. We've aligned our model with more than 130 compliance-related risk indicators, ensuring it accurately understands your business communications risks.

Why Global Relay is the trusted choice for AI-enabled surveillance

Driving progress in surveillance

With over 25 years of archiving expertise, we deliver unmatched data completeness. Our size, stability, longevity, and diverse team make us a trusted leader in the market. Our surveillance solution alone has been developed by a team of over 300 experts.

Around-the-clock customer support

Our global support team with offices in London, New York, and Vancouver ensure we’re always available. With 24/7/365 phone support, our highly experienced and friendly team members are available to assist you whenever you need help.

Contact the Global Relay Sales team to learn more about our end-to-end solutions for compliant communications.