The Conduct Chronicles – “Social Media. Who is really following us?”

Emma Parry discusses the emergence of social media and the risks that come with it. As a result firms are cracking down on monitoring their employees and screening their backgrounds, however, they must ensure they are being transparent in their pursuit.

Written by a human

Social media is undeniably an intrinsic part of our lives. Platforms enable us to stay in touch, to grow our networks, to earn a living. However, with the amount of information and opinions being shared, those with a social media account (or two) may find they have more followers than they had perhaps first thought. Increasingly, potential employers, current employers and even central banks and regulators are scanning social media platforms for insights. The question is, why?

Pre-employment screening

Many companies perform pre-employment screening that includes a sweep of social media profiles. This screening can undoubtedly provide valuable insights into positive indicators such as charitable work and volunteer roles. However, it can also uncover online activity and behavior by applicants that may pose a potential risk to a firm e.g.

- Illegal activities

- Hate speech, racist or discriminatory behaviour

- Inappropriate or undesirable conduct

- Sexually explicit or abusive content

- Potential substance abuse or addiction

- Extreme violence or threatening behaviour

- Obscene or abusive language

- Insults or bullying

Notwithstanding the potential risks uncovered, screening may also uncover protected characteristics, which cannot, of course, be used in the hiring decision. Moreover, the screening process must protect the candidate’s right to privacy. Such characteristics include race, religion, disability(ies), gender, age and skin color. Third parties that provide pre-employment screening ensure that such data is removed from the screening results.

Existing employees and ongoing monitoring

Some people may be surprised to learn that, in the UK, ongoing employee monitoring is legal. Of course, if a firm does determine that it needs to monitor its employees, there are various laws they must abide by, including the Regulation of Investigatory Powers Act 2000, and the Data Protection Act (DPA) 2018.

If you’ve yet to peruse the DPA, and it’s now languishing somewhat forlorn at the bottom of your holiday reading list, here are the six rules – the ‘data protection principles’ – that must be followed.

Employers must make sure the information is:

- used fairly, lawfully and transparently

- used for specified, explicit purposes

- used in a way that is adequate, relevant and limited to only what is necessary

- accurate and, where necessary, kept up to date

- kept for no longer than is necessary

- handled in a way that ensures appropriate security, including protection against unlawful or unauthorised processing, access, loss, destruction or damage

Needless to say, firms should in the first instance consider whether this type of monitoring is required versus adopting another approach. If a firm decides to monitor, it must have a policy in place that sets out its approach to monitoring, the information being recorded and monitored, the rationale, and the length of time such data and information will be retained.

Central Banks and Regulators

It’s not just employers who have implemented far-reaching monitoring policies. While our fascination with social media has grown, global regulators and central banks have also been taking a keen interest. And they’ve certainly not been sitting idlily by.

The European Central Bank (ECB), for example, has set out its policies as it relates to their monitoring of social media specifying that it ‘wants to understand how social media users discuss monetary policy and banking supervision, as well as other topics relevant to the ECB, so that we can take into account the needs of the general public in our communications.’

Some regulators are conducting more in-depth research, and specifically into the role that social media can play in potential detriment to retail investors.

For example, in March 2021, the UK FCA issued a press release highlighting findings from a behavioral science study it had commissioned that found that newer investors in high-risk products were ‘more reliant on contemporary media (e.g. YouTube, social media) for tips and news.’

The Australian Securities and Investments Commission (ASIC) is also commissioning studies. Its 2022 research into investment behavior highlighted that, of the 1,053 Australian retail investors if surveyed:

- 34% reported sourcing trading information from Google,

- Others stated that they source trading information from social media and networking platforms, including YouTube (20%), Facebook (11%), podcasts (10%), and financial influencers (10%).

Regulators have also been monitoring and investigating the more sinister side of social media. One area of focus is the increasingly prominent role of celebrities and influencers who have been busy on social media platforms promoting trading schemes and, in some cases, market manipulation schemes. In fact, when in September 2021 the UK FCA name dropped Justin Bieber, J Lo and the Kardashians in a speech, you know there’s a problem (ref. FCA).

More recently, in 2024, the FCA announced that it had pressed charges against nine British reality TV stars who appeared on Love Island and The Only Way In Essex in relation to an unauthorised foreign exchange trading scheme (ref. FCA). The FCA alleges the individuals were paid to promote the high-risk trading scheme on Instagram between 2018 and 2021. However, before you reach for the popcorn, we have some time to wait to see how this episode ends, as the case isn’t due to go to trial until 2027.

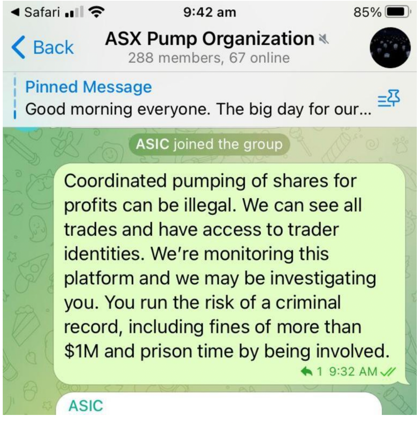

ASIC Joined the Chat

Meanwhile, in Australia, ASIC has adopted a far more assertive and disruptive approach to fraud facilitated via social media.

In a bold move in late 2021, ASIC joined the ‘ASX Pump Organisation’ Telegram chat warning its 300 members that the watchdog was ‘monitoring this platform’ and that members may be investigated. ASIC advised those in the chat that ‘you run the risk of a criminal record, including fines of more than $1M and prison time by being involved.’ Countering the allegation that the ASIC message was a hoax, ASIC issued a statement on its website confirming that it is ‘using social media platforms to directly engage with people who are involved in blatant pump and dump activity.’

‘Pump and dump’ schemes are a form of market manipulation. In this case, the chat forum was being used to artificially ‘pump’ the price of the crypto asset before the fraudsters planned to ‘dump’ their holdings leaving whoever was left holding a worthless asset.

The Verdict

Social media has opened a world of creativity and opportunity, however, with that creativity and opportunity comes risk. It’s little wonder therefore, with the magnitude of information and opinions shared online, that employers, regulators and central banks are taking a keen interest, with some deploying monitoring solutions to gain valuable insights.

Any monitoring must, of course, be proportionate to the risk presented, abide by the relevant laws and, most importantly, be transparent to those being monitored.

In a world where virtually anything is possible, we should always consider the impetus behind our actions. Just because we can, doesn’t mean we should.